The Future of Technology When Big Tech Has More Money Than Countries

The economy has seen a seismic shift since 2020. From skyrocketing valuations to unprecedented deal flow, venture capital (VC) and private equity (PE) have become more alluring than ever. At the center of this economic transformation are the Magnificent 7 — Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla. These tech titans wield so much financial power that their combined market cap surpasses the GDP of entire nations.

To put this into perspective:

Apple’s market cap alone crossed $3 trillion in 2024, overtaking the GDP of the United Kingdom and India.

The Magnificent 7 together boast a combined valuation of nearly $12 trillion — outpacing the total economic output of most of Europe.

Visual: Magnificent 7 Versus Global Economies

The Shift: From Safe Bets to Bold Innovation

Before 2020, the investment landscape leaned conservative. Investors favored stable industries and predictable returns. But the pandemic catalyzed a new mindset: disruption over stagnation. The gaps in our systems were exposed across industries — healthcare, supply chain, education, and communication. Suddenly, innovation wasn’t optional; it was necessary.

The outcome?

Venture capital investments reached $380 billion globally in 2023, up from $274 billion in 2019 (a 39% increase), despite economic headwinds. In 2024, early projections indicate a rebound to $410 billion, fueled by advancements in AI, climate tech, and healthcare innovation.

In 2024, global deal flow has shown signs of recovery, driven by surging investments in AI, clean tech, and advanced climate solutions, as well as growing interest in blockchain applications and next-generation healthcare innovations.

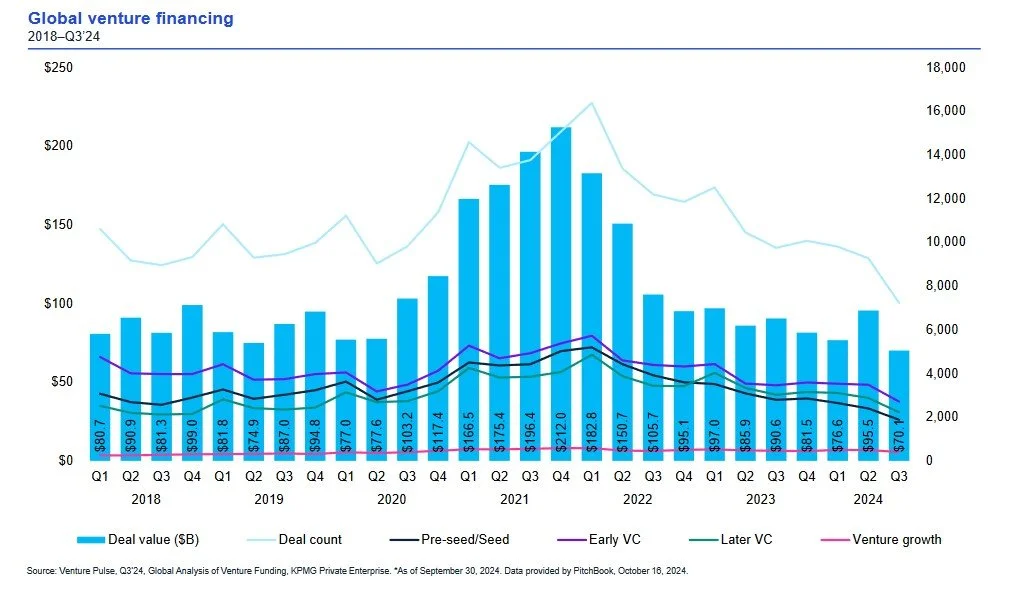

(Visual: The global VC funding from 2015 to 2024)

Tech innovation cycles have shortened, driven by advancements in:

Artificial Intelligence (Generative AI applications are reshaping industries at warp speed).

Blockchain (transforming finance and transparency in supply chains).

Clean Tech (from carbon capture to breakthroughs in renewable energy).

Why Investor Relations (IR) Matters in Tech and VC

Investor Relations (IR) often gets overlooked until the end of the investment lifecycle, but it’s one of the most powerful tools for firms and funds. Here’s why:

IR bridges the gap between operations, marketing, and strategy.

It’s the art of influence and persuasion, shaping narratives that attract and retain top investors.

IR provides a bird’s eye view of the entire investment lifecycle, ensuring alignment from fundraising to exit.

Strong IR builds relationships that drive capital and confidence — two essentials in a volatile market.

For tech firms and VCs navigating today’s landscape, strong IR strategy is the differentiator between thriving and merely surviving.

The State of Fundraising: 2023, 2024, and Beyond

While 2023 saw a slight cool down in VC activity due to rising interest rates and macroeconomic uncertainty, the numbers remain impressive:

2023 VC fundraising: $345 billion globally (down from 2022 but still double the 2015 figure).

2024 brings cautious optimism. With it being a U.S. election year, investors are prioritizing resilience and focusing on sectors like AI, climate tech, and fintech innovations.

Looking ahead:

2025 projections show a strong rebound, driven by:

Increased AI adoption and applications.

Breakthroughs in clean energy and decarbonization.

Growing infrastructure investments in emerging markets.

(Visual: The Global VC fundraising from 2019 to 2025 projections)

Investing in the Future

To be part of this exhilarating ecosystem, investors and founders alike need to identify the gaps and innovate. The future belongs to those who:

Spot opportunities in AI, climate tech, and Web3.

Build products that solve real problems and scale sustainably.

Harness relationships — through strong IR, networks, and communities — to drive long-term growth.

In a world where Big Tech’s financial power rivals that of nations, the possibilities for innovation, wealth creation, and positive disruption are endless. Are you ready to seize them?

Key Takeaway:

Technology has moved beyond being just an industry; it’s the backbone of the global economy. With innovation accelerating and Big Tech shaping the future, understanding how to invest, innovate, and build meaningful relationships is the key to thriving in this new era.